When you’re dreaming of getting rich, it’s easy to overlook the downsides of having money. One major risk of having a high net worth is that, once people know you’ve got money in the bank, they’ll try and take it from you. For this reason, wealth protection strategies are essential for anyone who is practicing systematic wealth building.

Are you wondering how to protect your wealth from lawsuits and predators? Are you concerned that once you finally “make it,” you won’t ever be able to relax and fully enjoy the fruits of your labor?

Don’t worry. It really is possible to be rich and have peace of mind. To do so, you’ll likely use a collection of wealth protection strategies to reduce the risk of being sued, having your income stream dry up, or otherwise having your assets dramatically drop in value.

At the end of the day, the more assets you have, the more strategic you’ll have to be to protect what is yours. Let’s dive in and take a look at what I’ve learned over the years about the best ways to protect wealth.

Asset protection refers to various strategies you can adopt to protect your wealth and property from creditors, lawsuits, and predators. You can practice asset protection strategies both at the individual level and for any business entities you operate.

If you’re new to the world of asset protection, the whole thing might sound paranoid to you. After all, who’s going to try and take your money?

Unfortunately, the more wealth you have, the more you can expect that others will try and get a piece of the action. Asset protection should be an essential tool in everyone’s financial planning. When you practice asset protection, you can enjoy the benefits of:

You might think that asset protection strategies are only for the mega-rich. Honestly, though, if you have any assets to your name and plan on building wealth over time, it’s never too soon to start protecting your wealth.

Before we get into the specifics of how to protect your wealth, let’s start with why your wealth is at risk in the first place. I want to mention first and foremost that you should not assume that you are safe from lawsuits and accusations against you because you do everything by the book and aren’t engaged in any shady business. The reality is that people can and do make frivolous, baseless lawsuits. Even if they won’t win, it can still cost you a lot in legal fees, time, bad press, and stress.

If you’re a business owner, you probably already know that there are potential pitfalls and risks just about everywhere you turn. That being said, let's take a look at some of the risks you face when you operate and own your company or work as a business professional:

Again, you don’t have to actually be at fault for predatory people to make these sorts of claims against you. If you don’t have your business and personal finances separated, you might find that your personal assets are at stake when someone comes after you professionally.

Even if you’re retired or generally not concerned about your professional liability, you’ll still want to consider the ways that your personal wealth is at risk:

I’ve said it before, but it’s worth repeating: the more money you have, the more likely it is that predatory people will try and take it from you. The scent of money can make people do strange things, and the apologetic person that was obviously at fault in a car accident might start to sing a different tune when they realize who you are or how rich you are. You can’t necessarily completely avoid these risks in life, but you can set yourself up with wealth protection strategies that make it so your money isn’t unguarded from opportunistic parties.

Now that we’ve looked at why you need to protect your wealth, let’s dig in to the how.

I'm a big believer in the fact that, while money is an incredibly powerful tool, it isn't the only thing that matters. Check out my complete guide to the different types of wealth you need for a meaningful and fulfilling life.

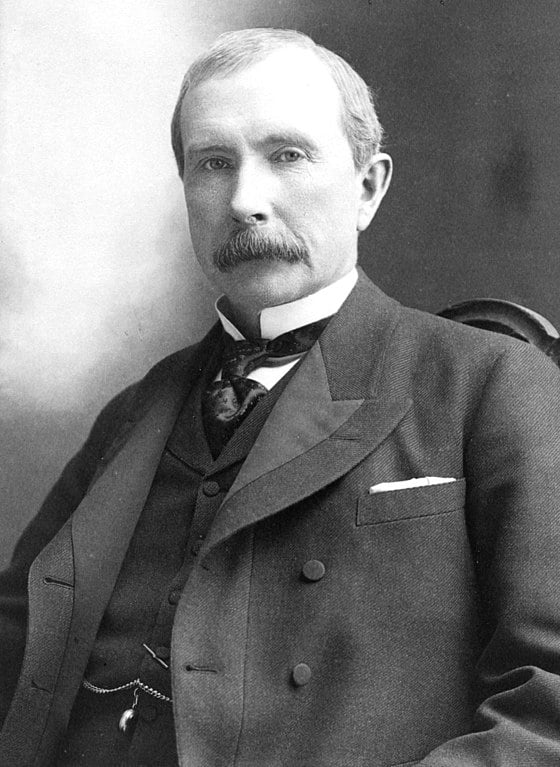

John D. Rockefeller once famously gave the advice that you should “Own nothing. Control everything.” This is an oft repeated quote in the world of asset protection and the offshore industry, promoting the idea that no one can take something from you if you don’t own it.

While it might make the purchasing process a bit more complicated, ensuring that none of your assets are owned in your name can provide serious wealth protection. You also might choose to retitle the assets you already own so that they can’t be taken from you in the case of a legal dispute. Some people also choose (in certain states where it’s advantageous to do so) to title their assets as tenants-by-the-entirety with a spouse.

Depending on the state you live in, your home equity might be safe from creditors through homestead protection. However, how much protection you really have is going to vary a great deal depending on which state you’re in.

There isn’t one go-to strategy for avoiding owning your assets outright in your own name. Here are some of the ways that wealthy people control their assets without technically owning them:

An additional benefit of avoiding owning anything in your own name is the anonymity it provides. If you purchase property with a trust or an LLC, (which, by the way, is definitely more complicated and involved than buying a house as an individual,) you don’t have to worry about the fact that your family’s home address is a part of the public record.

Are you an entrepreneur?

If so, you’ll definitely want to separate your personal assets from the assets, debts, and liabilities of your business sooner rather than later. LLCs are a popular method for a number of reasons, one of the primary of which is that creditors can’t go after an LLC owner’s personal assets in the event of the company going under or a lawsuit. Unless you act in a way that leaves a court feeling justified to pierce the corporate veil, the only assets at risk if your business is sued or creditors pursue it are those that are invested in the business itself.

Depending on the state you live in, you might be able to put some of your assets into a trust that creditors can’t access. However, this isn’t something you should try and start doing when you feel like a lawsuit is imminent. Creating trusts for your assets is something that you’ll want to do years in advance of any judgments or unpaid debts.

There are a lot of different types of trusts out there, and determining which ones are right for you should be a part of your larger estate planning efforts. Some of the types of trusts that might be applicable in your asset protection include:

In any case, I could go on. The short story is that trusts can be a valuable tool in your asset protection strategy, but they’re also pretty complicated and not something to mess around with lightly. It’s generally a good idea to work with a knowledgeable attorney who can make recommendations based on your specific circumstances.

When the name of the game is asset protection, your arsenal should be loaded with insurance, insurance, and more insurance. This is the first line of defense against liability, so this isn’t where you want to try and cut corners.

You should periodically make sure that your policy limits are in line with your current net worth and assets for insurance to serve as an effective method of asset protection. Depending on your situation, here are some of the types of insurance you might want to have protecting you at all times:

It’s also worth understanding deposit and securities insurance. For example, up to $250,000 per depositor, per bank, and per “ownership category” is insured by the Federal Deposit Insurance Corporation (FDIC) for member banks. Using this in your favor can ensure that your money in individual accounts, joint accounts, trust accounts, IRAs, and more is protected to the fullest extent.

No matter what you’re investing in, it’s never possible to completely avoid risk. After all, even if you hide your money under the mattress, it’s just going to get demolished by inflation over time.

That being said, there are ways you can significantly reduce your risk when investing. One of the common tactics used to help preserve your capital is by diversifying your investments.

The more diversified your investments are, the less impacted your portfolio will be by market anomalies. To protect your assets from unexpected events, some of the asset classes you might consider investing in (after thorough due diligence, of course,) include:

In short, you want to invest in several different asset classes and sectors that typically react differently to various types of events. If you’re not diversified, you might not even realize how much risk you’re taking on until something catastrophic wipes out your principal. For example, imagine if you were months away from retirement with all of your capital invested in tech stocks when the dot-com bubble burst. Ouch.

Another important step you can take to protect your wealth is to diversify your business income. As they say, don’t put all your eggs in one basket.

If you have a stable, high-income W-2 job, you might think this doesn’t apply to you. However, diversifying your business income is just as important for 9-5 workers as it is for entrepreneurs.

When you have several different sources of income, it can act as a hedge against income loss, provide stability, and help you systematically build wealth. In these arguably uncertain economic times, having several different irons in the fire can also help to keep you financially agile.

If something catastrophic happens, diversifying your income can mean you don’t have to go down with the ship. If everything continues chugging along as planned, having several sources of income can have a huge impact on your ability to build wealth and fund your retirement.

Diversifying your income is an important strategy that keeps the long-game in mind. Even the most successful companies can lose relevancy and go under, and even the healthiest income streams can dry up over time.

Lastly, having a number of different sources of income can help keep life interesting! It can keep you on your toes, keep you engaged, and help avoid the all-to-common disease of complacency.

Related to the need to diversify your business income, diversifying your skills can also go a long way in protecting your wealth.

In Stoic philosophy, one of the main principles is that some things in life are in your control and some things aren’t. Your main task is to distinguish the difference between these two camps. Once you’ve done that, you can work to accept the things you can’t control and focus your energy towards the things that you can control.

Unless you are one of the elite group of people in the world that have the power to directly affect change at a global scale, you likely can’t control what happens economically, politically, or geopolitically. You don’t have the power to start wars or end wars and you don’t have the power to impact the housing market in a meaningful way.

What you can control, though, is what you do. You can control the skills you choose to master.

When you have a diversity of skills, it means that you are all the more able to pivot in the face of unexpected life events or global occurrences. Mastering a variety of skills doesn’t just mean you might have the right skills to call upon in the face of a crisis, but it also means you’ll be more equipped to gain new skills when necessary. If you are constantly pushing yourself to travel beyond your comfort zone and learn new things, you’ll be able to hop back on your horse a lot faster when you get knocked off.

If you’re not convinced yet, let me also just say that building a diversity of skills also helps to keep you engaged and fully alive. It’s easy to go to your 9-5 everyday and let the days slip by without ever pushing yourself to become more. When you invest in your skills, you’ll find it helps to produce a zest for life you might have thought automatically disappears once you reach adulthood.

As you start building your net worth, one thing you’ll want to understand is that the odds of getting hit with lawsuits starts increasing exponentially the more money you have. If it’s common knowledge that you’re doing well financially, the sad reality is that there’s a good chance people will start coming out of the woodwork to try and get a piece of the action.

Don’t assume that you can avoid this outcome by obsessively doing everything by the books, being incredibly charitable with your wealth, and never uttering a harsh word to another soul. It is not beyond predatory people to make frivolous, baseless lawsuits against someone they know has some money in the bank.

For this reason, you’ll want to build an aggressive team that you can call upon at any time to vigorously defend your interests. If someone files a lawsuit against you, no matter how vulnerable you are in reality, you should never be afraid to bristle when someone threatens legal action against you.

In fact, the more vulnerable you are, the more you should fight to look less vulnerable. When someone is threatening to sue you, they are declaring war. In these instances, you’ll want to follow the advice outlined in one of the most influential strategy texts of all time, the Art of War:

“All warfare is based on deception. Hence, when we are able to attack, we must seem unable; when using our forces, we must appear inactive; when we are near, we must make the enemy believe we are far away; when far away, we must make him believe we are near.” - Sun Tzu

This isn’t the time to play nice– the more aggressive you are against legal attacks, the clearer you make it that you’re willing to put up a fight. Lawsuits are expensive, and when you start beating your chest like a silverback (metaphorically, of course), it makes it clear that it’s going to be costly to try and take you down.

The goal here is to never appear vulnerable. Asset protection can go a long way in creating that appearance. If you have bombproof asset protection strategies in place (like utilizing management companies to keep your holding companies cash free, avoiding owning anything in your name, and being willing to contest every tiny legal detail,) lawyers will see that the legal battle likely isn’t worth fighting. Through aggressive asset protection and an even more aggressive legal stance, you can swat away anyone that even thinks about opportunistically taking your money.

It would be nice if we lived in a world where you could run around making verbal contracts and assume everything will work out alright. In reality, approaching life, business, and other people that way is probably going to burn you pretty quick.

If you’re constantly saying “I’ll take your word for it,” you’ll learn this the hard way. If you’d like to avoid this, always act from the assumption that it’s best to get everything in writing.

You likely understand the importance of contracts when it comes to business deals, real estate deals, and legal matters. (If you don’t, now is the time to start.) But getting everything in writing can also refer to things that you might not think are that important. Creating a paper trail helps to provide certainty in just about every situation for everyone involved, even if you’re not worried about there being any malicious intent.

Prenups often get a bad rap, but they are an absolutely essential tool for anyone that wants to protect their wealth. When you and your soon-to-be spouse create a thoughtful prenup together, it can help to protect both of your interests in the case of separation, divorce, or death.

However, a prenup really isn’t just a laundry list of who gets what if the marriage doesn’t work out. It can also be a way for you and your fiance to create a financial plan for married life that will actually help to avoid arguments over money and finances down the road. On top of that, it can be an important exercise before marriage to make sure that the two of you are fundamentally on the same page when it comes to wealth building and protection.

In the event that you and your spouse get divorced or one of you passes away, a prenup is a document that lets the two of you stay in control of what happens to your assets. This can save a lot of headache, drama, and stress down the road. In general, you’ll be in a much better position to make level-headed decisions about asset distribution when you aren’t actively embroiled in a divorce or grieving the death of a spouse.

You might not like this one, but the reality is that one of the best ways you can protect your wealth is by building more. Though it’s not the cheeriest news, the truth is that the more you earn, the more you can afford to pay for safety. This is an inherent part of living in a scarce-resource universe– resources allow you to have more options and more security, regardless of whether you’re talking about financial, personal, or political resources.

The more wealth you have, the more peace of mind you can buy. If you’ve ever stressed about money– and let’s be real, we all have– you know just how priceless the ability to relax really is.

On top of that, building more wealth is the most reliable path to having the freedom over what you do. The more money you have, the more ability you have to protect the most valuable asset to your name: your time.

The point of getting rich isn’t so you can spend your days cackling and counting your cash. The point is to allow you to engage with life in meaningful, purpose-driven ways. If you’ve ever lived paycheck to paycheck, you know just how impossible it can be to pursue your life goals when you’re scraping together pennies to fix your car or pay your rent.

What’s one of the best ways that you can protect your wealth from lawsuits and predators? Easy. Don’t let anyone know you’re rich.

For an in depth look at the concept of keeping your wealth a secret, check out my article on stealth wealth here. There are a lot of benefits to practicing a stealth wealth lifestyle, one of which is helping you avoid frivolous, baseless lawsuits from people who have nothing better to do than try and take your money.

When you don’t advertise that you’re wealthy through your home, car, clothes, and Instagram account, opportunistic predators will look right past you. Similarly, you can avoid the whole uncomfortable experience of second-cousins-once-removed and friends from the second grade calling up out of the blue to see if they can squeeze you for some cash.

While researching and putting in place asset protection strategies might not be everyone's idea of a good time, it’s absolutely essential to hedging against future financial disaster. On top of that, you’ll find that once you know your wealth is protected, you sleep a lot better at night.

If you’re as passionate about wealth building as I am, you’re likely also passionate about protecting your wealth from lawsuits, predators, and unexpected events of any kind.

Are you wondering why you should take my advice when it comes to something as important as asset and wealth protection strategies? You can learn more about me and my projects here.

We encourage you to share this article on Twitter and Facebook. Just click those two links - you'll see why.

It's important to share the news to spread the truth. Most people won't.