You learn a lot about someone's way of thinking by how they predict the future. Many, if not most, people make all sorts of strong conclusions and predictions with little-to-no evidence and never realize how big of a deal that is when their predictions inevitably don't happen.

Nearly everybody claims, "I knew it!" about major social events that they absolutely, without question, did not know. Nearly every middle-aged dad in the world claims they "knew" they should have invested in Google, Bitcoin, and all sorts of other things they absolutely never saw coming. To see examples of delusional people who don't realize how comically ignorant their predictions are, just find anybody - usually a man - who is "thinking about day trading" for a living. Foolishness.

Below, I'll lay out the 7 fundamental principles for predicting the future, touching on similar concepts as I've written about in my article about how to predict the future. I'll then lay out the predictions at the bottom of the article, along with the dates of the predictions and the dates of any modifications.

2010 - SEO:

Early in my career, I built websites that generated revenue by having traffic from Google searches. This is called "SEO" or "Search Engine Optimization." I was involved in several internet marketing forums and became an outspoken advocate for the idea that Google would soon be cracking down on nearly every "tactic" that worked. I was banned from two forums because I was scaring people. I decided to sell my biggest website before the big algorithm changed. Google eventually did change everything in 2011 - wiping out countless thousands of people, as I predicted.

I was still impacted, but much less than most people were because of my interest in forecasting major trends. To me, the lesson was to double down on accurate forecasts so that I could completely avoid at least some massive surprises.

2011 - Social Media News:

I invested very early into Bitcoin but ended up liquidating my position because I believed that political news on social media was a massive opportunity. I threw my entire net worth into building what I believe was the first political news company that was 100% focused on social media traffic. I began in 2011, and in 2013 threw every penny I had into it and launched a website that became one of the most popular websites in the world with millions of visitors per day.

I then surprised nearly everyone who knew me in the industry by selling and completely getting out of the social-media news market. I decided to sell in 2014 and finalized the sale in 2015. It seemed stupid at the time, but I'll explain why below.

2013 - Bitcoin:

I've always found it exciting to try to be early to markets and predictions while still being cautious and nuanced. For example, in 2013, I wrote that:

"[Bitcoin is a] massive possible opportunity [and] the possible payoff for the cryptocurrencies is simply staggering. If anything, the off-chance that the currencies become even medium-sized alternatives to fiat currencies is reason enough to put some money in the coins as a speculation."

2014 - Big Tech Censorship.

Before "fake news" was being used to describe any media report that someone disagreed with, I was extremely aware of the future of censorship by major tech companies. It's weird to talk about now, but nobody was discussing censorship by big tech as a real thing in 2014 or 2015. It was an afterthought. To me, however, it was the biggest risk that existed. So I sold the business.

The website I sold? It doesn't exist anymore. It effectively shut down and was merged with another website because censorship wiped it out, just as I was concerned.

In 2019, a Pulitzer-prize-winning NY Times journalist reached out to interview me about why I was able to see that coming years before it was in any news cycle.

2020 - Covid.

When Covid first began spreading, I was the first person I knew who went into quarantine. I also shifted my entire retirement accounts into Treasury bonds because I believed that the dollar and related assets would skyrocket as people fled to financial safety. I was right. Then a few months later, stocks had imploded and I rolled my money back into stocks because it was clear that the money printing was going to create a massive stock-market boom. That also worked out.

I dabbled in options for the first time and made several hundred thousand from a tiny starting amount.

2021 - Interest Rates.

In late 2021, as in December, I scrambled to do a cash-out refinance of all of my real estate holdings, both personal and investment, in order to lock in long-term interest rates and pull cash out before interest rates went up. This ended up being perfect timing. Within a couple of months, rates had skyrocketed. This move allowed me access to nearly a million dollars more than I would have had and saved millions and millions of dollars over the next ten years.

Monetary economics is an incredibly useful discipline to understand if you want to monetize any prediction. It allows you to understand the news financially better, even when the news isn't directly financial. It does, however, require leaving political ideology and populism at the door. But it's ok, you'll get paid handsomely if you have the guts to do it.

Predictions aren't just fun, they're also lucrative. The universe rewards people who can accurately forecast the future. If you can see a market early, move fast, and sell before troubles hit, you'll have an extremely financially rewarding life. All of the above predictions (other than 2020 and 2021) were made before I was 26, and they allowed me to retire at 26. Pretty crazy.

Anyway, enough talking about previous predictions. Let's look at the principles for developing a good prediction:

I've written a little bit about predicting the future before. It's endlessly fascinating.

Fundamentally, some of the predictions will be annoyingly vague, because they should be comprehended, and internalized, but are impossible to comprehend with perfect specificity.

NOTE: These aren't created for anyone other than myself. Most of them will be hard to prove. This is a personal project, so that's fine.

FIRST UPDATED: 5/6/2023. Any additions or edits will have the later date next to them below.

AI Predictions:

Political Populism

Inequality

Social Unrest

Mental Health

Material Prosperity

Prosperity Denial

Return to Tradition

As time goes on, I'll add to the above predictions.

Caring too much about what other people think about you puts you on the fast track to a life that is dissatisfying, hollow, and unnecessarily painful. Assuming that isn't what you want, this article serves as a crash course in Stop Caring 101.

Our human instinct to desire the approval of other people might have been necessary for survival in the cave days, but it doesn't mesh well with modern life.

If you're ready to take charge of what you can control in life and make yourself into the person you want to be, shifting your energy away from other peoples' thoughts and opinions about you should be high on your priority list.

Do yourself a favor and read through this entire article. If you stop caring about what other people think about you, you'll feel a sense of liberation you've never experienced before.

Before I get into how to stop caring what other people think, it's important to dive into why we care in the first place.

Back in the days when humans co-existed in the wilderness with saber-toothed tigers and wooly mammoths, people had every reason to not want to get left behind.

Before the safety net of civilization, the world was filled with perils we don't think much about anymore-- starvation, exposure, and predators, to name a few. Staying alive depended on being a part of a close-knit tribe or clan. To survive in that world, group inclusion was a must.

In a modern context, though, this instinct can manifest itself in ways that are practically absurd. A few thousand years ago, you might have understandably felt tremendous fear when kicked out of the group to fend for yourself in the wilderness. Sounds pretty reasonable, doesn't it?

These days, however, the same anxiety and terror might arise in response to the mere idea of receiving negative comments online or being judged for your clothes, looks, profession, or personality.

From an evolutionary standpoint, caring what other people think makes perfect sense when you only have two choices: belong or die.

We don't live in that world anymore, though, and fixating on the perspectives of others will most likely keep you from living a productive, meaningful, and fulfilling life.

So, what is happening in our brains when other people approve of us?

One study from University College London and Aarhus University in Denmark found that when other people agree with and validate our own opinions, the area of our brains associated with reward is much more active.

These researchers also found that some people seemed to be more influenced by the opinions of other people than others, which they could actually predict by looking at their brain activity.

If you are guilty of caring too much about what other people think, you can cut yourself some slack by realizing that we are, to some extent, evolutionarily and biologically programmed to value the opinions of others. That being said, it is possible to overcome this impulse and improve your life dramatically.

One more thing before we jump in: there are definitely benefits to having a sense of belonging within a group. This primer on how to stop caring what people think is not advising that you should stop being empathetic and alienate yourself from everyone you've ever known.

Humans are fundamentally social creatures, and it's important to have deep connections with other people. Experiencing a feeling of belonging with a group can help us manage stress, be more resilient, and support the stability of our mental health, to name just a few of the benefits.

After all, one of the greatest gifts and joys of life is the wealth of family and friendship-- truly knowing and loving other people.

On top of that, the feedback and opinions of other people can be incredibly valuable. Not caring what other people think about you doesn't mean closing yourself off from the useful perspectives of others.

Sometimes, people you love and respect can hold a mirror to you in a way that helps you grow. No one is born perfect, and we can learn a lot from others. The point is to be able to stay centered in yourself and discern valuable feedback from superfluous, judgmental, or superficial opinions.

Many of us, however, go way too far when it comes to caring what others think.

It is far too easy in our modern world to let other people's opinions (or worse, our lousy guesses of what we think other people will think) dictate what we do, how we act, what we say, and, ultimately, who we are.

Ok, so now we have a picture of why we tend to care way too much about what other people think.

The next step is to understand what this might be costing you.

“Care about what other people think and you will always be their prisoner.”

—Lao Tzu

This is a big one.

It's possible to go through your whole life letting other people define who you are without even realizing it.

When this happens, you deny yourself one of your greatest powers: the ability to deepen your relationship with yourself over the course of your life.

“The greatest fear in the world is of the opinions of others. And the moment you are unafraid of the crowd you are no longer a sheep, you become a lion. A great roar arises in your heart, the roar of freedom.”

– Osho

When you don't know yourself, how can you know what you want out of life? How can you know what your goals and purposes are? Hint: you can't.

When you value what other people think over your own thoughts, opinions, and beliefs, you're on a one-way path to becoming a pushover. The fear of negative judgment can leave people unable to stand up for themselves and make them easy to influence or manipulate.

When you care too much about what other people think, you're bound to spend your life disappointed.

Why, you ask? Because you can't actually ever please everyone.

Even when you do everything in your power to fit in and be accepted, you simply can't control what other people think. This means that you could spend your entire life expending energy in a way that is ultimately fruitless.

What do you want to do with your life? When you're old and gray, what do you want to look back on your life and know you've done? What will you regret not having done?

“Most people are other people. Their thoughts are someone else’s opinions, their lives a mimicry, their passions a quotation.”

— Oscar Wilde

When you're too concerned with what other people think, it can keep you from pursuing your life goals or even knowing what they are.

Caring too much about what other people think isn't a new phenomenon. The infinitely wise Roman Emperor and Stoic philosopher, Marcus Aurelius, observed this aspect of human nature nearly 2,000 years ago:

“We all love ourselves more than other people, but care more about their opinion than our own.”

– Marcus Aurelius

If you put too much stock into what others think, you'll be devaluing your own perspectives. It might even mean you don't know what your own perspectives are.

If you are fixated on what other people think about you, you likely deal with a good deal of anxiety. Caring about what others think can lead to constantly burning energy obsessing over how you will be judged or praised for any little action.

Anxiety can range from unpleasant to debilitating. No matter the scope, it can seriously get in the way of actually living the life you want. On top of that, it can lead to a long list of physical ailments.

If you want to free yourself from anxiety, learning how to stop caring what people think about you will go a long way.

Finally, you probably won't live the life you want if you're prioritizing what other people think.

“Your time is limited, so don’t waste it living someone else’s life.”

— Steve Jobs

You want your loved ones to live fulfilling and purpose-driven lives, don't you? So why wouldn't you want the same for yourself?

One of the first steps on that journey is letting go of the attachment you have to other people's affirmation, validation, and positive opinions of you.

Our lives on earth are finite. Once you stop caring what other people think about you, you can begin living the life you want.

Now it's time to look at some of the practical things you can do to stop overprioritizing the opinions and thoughts of others.

It is terrifyingly easy to go through your whole life never really knowing yourself.

If you don’t know who are you, you’re a lot more likely to let other people’s opinions define you and your sense of self-worth. When you don’t have an intimate relationship with your true self, there’s a good chance you will live your life driven by external forces or focused on pleasing other people rather than fulfilling your dreams, goals, and purposes.

The importance of getting to know yourself is quite clear: when you don’t know who you are, how can you possibly be making the best decisions that define your life?

“Nothing gets us into greater trouble than our belief in untested advice; our habit of thinking that what others think as good must be good; believing counterfeits as being truly good; and living our life not by reason, but by imitating others.”

— Seneca

If you’ve never spent much time getting to know yourself, starting the process can be scary. After a while of some dedicated self-work, though, you’ll find priceless wealth inside yourself.

Getting to know yourself is a process you can go through for the rest of your life. One of the best things you can do to discover your true or inner self is to simply sit quietly. We are constantly inundated with other people’s thoughts, ideas, images, marketing tactics, etc.

Sitting quietly with your own thoughts can be surprisingly difficult if you’ve never made a habit of it. In a time before radio, TV, the internet, and smartphones, quiet meditative time was often built into the daily life of humans around the world. These days, we have to purposefully seek it out.

“Everyone rushes elsewhere and into the future, because no one wants to face one's own inner self.”

– Michel de Montaigne

When you’re getting to know yourself, remember to not be too hard on yourself. It’s also important to recognize when you’re focused on who you think you should be rather than who you are. Instead of judging the thoughts and feelings that come up, realize that finding the truth of who you are is the most important thing.

The more you are in touch with who you are and what you want out of life, the less likely you will be to let other people’s opinions bother you. Even if you do find yourself caring about what people think way too much, you’ll always be able to return to your inner resources and stay on your chosen path.

What are your values? What are the underlying principles you hold that dictate your sense of what is important in life? What are the core ideas that are driving you to do what you do day in and day out?

If you have no idea, don’t worry. It’s possible that by discovering what your values are, you will be much less likely to care about what others think about you.

“If an action or utterance is appropriate, then it’s appropriate for you. Don’t be put off by other people’s comments and criticism. If it’s right to say or do it, then it’s the right thing for you to do or say.”

– Marcus Aurelius

If you start to look into the concept of values in ethics and social sciences, it can start to make your head spin. There is some debate about whether some ideas that are considered values are intrinsic while others are better classified as vices or virtues. Don’t get too caught up in this level of thinking when you’re starting out– instead, just focus on the ideas that you believe are important and that inform the decisions you make.

Some examples of personal values, in no particular order, are:

We all pick up values along the road in life, whether we realize it or not. Maybe you have values that you learned from your religious faith, your parents, your community, or your culture. Maybe some of your values developed during your own path of personal growth.

When you’re making a list of your values, try not to censor yourself too much.

Don’t write down the values you think you should have, write down the values you feel really guide you. If there is a discrepancy between your values and how you act, this is a great way to discover it and begin a new, exciting process of growth.

When you have a sense of your values, you basically possess a map that you can carry with you through life. This can be of tremendous benefit to you if you feel that you care too much about what others think of you.

If someone expresses a negative opinion about you or accuses you of doing something wrong, you can simply refer to this map.

Are you acting based on the values you believe in? If not, you can be grateful to the person for helping you realize that you’ve wandered off your desired path. If you are, though, you have a lot more mental strength to not be bothered by criticism or judgment.

You might think that caring what other people think is a sign of a selfless, humble person.

In reality, though, it can also be a symptom of not taking responsibility for your own thoughts and feelings.

When you obsess over what people think and let their opinions dictate your life, you're essentially letting them live rent-free in your head.

You don't have control over what people say about you. What you do have control over is how you react to the negative, baseless, or unflattering opinions of others.

"You have power over your own mind - not over events. Realize this, and you will find strength."

– Marcus Aurelius

From a Stoic standpoint, you'll want to learn to accept things you can't control and focus on the things you can control.

What other people say, do, or think isn't something you have direct power to change. What you can control are your mindset, reactions, attitude, opinions, and beliefs. You can control your own mind, and if you succeed in doing so, you will change your life.

It's great to aim high in life, but being a perfectionist can seriously hold you back. What is perfection, anyway? Whose definition of perfection are you using?

“Some people say you are going the wrong way, when it’s simply a way of your own.”

— Angelina Jolie

If you care too much about what other people think, it can mean you do everything in your power to not be seen in a negative light. While it might feel nice for our ego to never have anyone witness us make a mistake, mistakes are how we learn, grow, and mature.

"The perfect is the enemy of the good."

— Voltaire

When we focus too much on being perfect, we can value the feedback we receive from others far more than our own personal growth. If we're more concerned with avoiding failure than bettering ourselves, we're seriously holding ourselves back. In the words of Theodore Roosevelt, "the only man who makes no mistakes is the man who never does anything."

The affirmation cycle is something that pretty much everyone gets caught up in at some point in their lives. Some people even spend their entire lives there.

No, I’m not talking about the New Age sense of affirmations where you say positive things to yourself every day to achieve success in life.

I’m talking about the affirmation and approval that we seek and receive from others throughout our lives. Maybe you received validation for being good at sports, creatively talented, or for getting good grades. Maybe it's for your looks or personality.

It’s all too easy to get addicted to receiving the approval of others, so much so that you let the expectations and opinions of others rule you’re entire life.

On the other hand, maybe you didn’t receive enough affirmation in your life. Maybe you were constantly seeking the approval of your parents or another authority figure, always to be left hanging. This can keep you scrambling for pats on the back in your life, rather than fulfilling your own goals and purposes.

When you are so focused on receiving affirmation and validation from other people, you tend to:

It is, sadly, possible to go through one’s entire life without ever really getting in touch with the inner self, the true self. It is possible to only be concerned with what other people think is good, what other people want, and what other people give you validation for. This is a terrifying premise, to me at least, and I expect that it is to you, too.

It’s natural to want to have control over our lives. The reality is, though, that a lot of the things we encounter are completely out of our control.

If you’re a student of Stoicism, this is probably an idea you’re familiar with. If you aren’t, stick with me for a minute.

Your entire life can change if you start to distinguish between the things you can control and the things you don’t have control over. It might seem distressing at first to accept that there are things you can’t control. After all, if you don’t have any sway over what happens, isn’t life just chaos?

If you sit with this idea for a while, though, it can be incredibly liberating.

According to Epictetus, one of the great ancient Stoic philosophers (and a slave for the first chunk of his life), we have control over very little. We don’t have control over:

That’s right– not even our bodies are fully under our control.

You might be wondering, what does this even leave for us to have control over?

The answer: our opinions, our thoughts, our desires, our aversions, and our own actions.

That’s right. You have control over how you think and feel. You have control over how you react to the things that happen to you. You have control over what you do and do not do.

What that means is that other people don’t have control over how you think or feel.

This is one of the most powerful ways to stop caring what other people think about you.

You don’t have to let other people’s opinions get under your skin or make you feel unworthy. You don’t have to let your imagination of what other people will think dictate what you think, believe, and do.

At the same time, this way of thinking can help you realize that other people are just as in control of their own thoughts and actions as you are. The more you value the freedom you have in controlling your own opinions and behavior, the more you will respect that same freedom in other people.

If you contemplate this idea frequently and incorporate it into your daily life, you’ll realize that your entire mentality shifts. Seriously– it’s a game-changer.

Have you ever had anyone assume they know how you’re feeling and what you’re thinking in a way that was totally off-base? Of course, we can sometimes glean a general idea of what others are thinking without them saying anything– body language, facial expressions, and general vibes are also incredibly communicative.

That being said, it can be pretty annoying when other people make assumptions about where you’re coming from when you haven’t told them what you’re thinking. When you expect other people are judging you, you are guilty of the exact same thing.

In the same way that other people don’t always know what you’re thinking, you can’t know with certainty what other people are thinking.

If you’re walking around with the idea that everyone is judging you, making fun of you, or otherwise belittling you in their minds, there’s a good chance that you’re completely missing the mark.

When you zoom out on this illustration it’s pretty remarkable. Picture yourself walking around a grocery store, for example, with thought bubbles that are wholly concerned with what other people are thinking. All the other people in the store have their own thought bubbles, that are fairly benign and completely unrelated to you.

Seems kind of silly, doesn’t it?

That’s usually what’s happening when you assume you know what people think.

We think about ourselves a lot. According to an article from Scientific American, people spend 60% of conversations talking about themselves, on average. When communicating on social media platforms, 80% of communication is just people talking about themselves.

If we spend this much time talking about ourselves to other people, one can only imagine how much time we spend thinking about ourselves.

“You probably wouldn’t worry about what people think of you if you could know how seldom they do.”

― Eleanor Roosevelt

Sometimes, we can get caught in cycles where we are super self-conscious of who we are, what we look like, and everything about us. We go to a party and are consumed with the idea that everyone is paying attention to us. Our hearts start pounding and our mind is racing, obsessing over the fact that everyone is talking about just how lame we are.

What’s most likely happening, though, is that almost no one is thinking about you. I don’t mean this to be mean– it’s not that you don’t matter. If you can realize how much time you spend focusing on yourself, though, it can give you a window into what everyone else is most likely thinking about: themselves.

Why waste your time worrying about what others think when they might not be thinking about you at all? If we’re all just walking around thinking about ourselves most of the time, why not use that time productively? And that brings me to my next section… understanding the opportunity cost of caring about what other people think.

When you spend time thinking about something, you are (consciously or unconsciously) choosing to focus on that topic rather than absolutely everything else you could be thinking about or doing.

The truth is that our time is limited. We only have so many hours in the day and we all have only so many days in our lives.

“Don’t waste the rest of your life worrying about others — unless it is for some mutual benefit. The time you spend wondering what so-and-so is doing, saying, thinking or plotting is the time that’s lost for some other task.”

— Marcus Aurelius

Every time you think about what people would think if you wore that outfit, quit your job, or started a band, you are doing so at the expense of every other possibility in the universe.

At the same time, you’re pouring your energy into these topics in a way that most likely impedes your growth. What if you took that energy and put it elsewhere? What if you took that energy and put it toward something you actually had control over-- like who you are, what you accomplish, and what your life is like?

In order to not care what other people think, a few things are necessary.

You need to believe in yourself. You need to trust yourself. You need to take care of yourself.

You need to accept yourself.

When you have these tools in your arsenal, you're much less likely to get completely bowled over when someone expresses negative opinions about you. You can't control other people, but you can control how you feel about yourself. The truth is, the more you do in life, the more criticism you will receive no matter how selfless or genius your actions.

“There is only one way to avoid criticism: do nothing, say nothing, and be nothing.”

― Aristotle

Accepting yourself isn't easy, but with dedicated self-work and attention, it's possible.

We are all connected to hundreds or even thousands of people through our family, friends, school, work, and social media. When you find yourself fixated on the opinions of other people, it’s important to ask yourself who this person is and why their opinion matters to you.

“Who are these people that you want to be admired by? Aren’t they the same ones whom you used to call crazy? Well, then, do you want to be admired by madmen?”

– Epictetus

You'll also want to distinguish between actual feedback and the anxious ramblings of your own mind-- i.e., did someone actually give you their opinion, or are you just letting your imagination run wild?

It’s possible that someone's opinion does matter to you. Maybe you are receiving constructive feedback from your grandfather about a life decision you are making, and you have learned to trust and respect his opinion over the years. If this is the case, you might find that learning what other people think about you is incredibly valuable and useful to your life and growth as a person.

On the other hand, maybe you are feeling judged by someone that you basically don’t know at all. Should you let this person live rent-free in your mind? Why would you let their opinion impact your life at all?

It’s not that you should necessarily go through life completely unwilling to entertain what other people think about you. Sometimes, people have useful feedback that can legitimately change your life. No one is perfect, and sometimes we need some help from the outside.

But you also shouldn’t go through life trying to win validation from people you don’t actually know, care about, or respect. There are plenty of things to concern yourself with in life, but the snarky comment that girl you knew in middle school left on your Instagram photo probably isn’t one of them.

Have you ever heard the Jim Rohn quote that “you are the average of the five people you spend the most time with”?

Depending on your social circle right now, this thought might be absolutely terrifying. The reality is that we are a lot more influenced by the people that we know than we might want to admit.

If you find that you care too much about what other people think, it’s possible that it’s all in your head. On the other hand, it’s also possible that you’re around people that are constantly judging you, criticizing you, and pulling you down.

Are the people you’re around disrespectful to you and not supportive of you? Do you feel more beaten down than lifted up by your friends? If so, it might be time for a change of scene.

According to the Pew Research Center, about two-thirds of Americans say that social media has “a mostly negative effect on the way things are going in the country today.”

Social media has also been found to be a “significant contributor” to stress, anxiety, and low mood. On top of that, several studies have linked social media use with a greater risk for depression, and research has also found that people that use social media often are more likely to have sleep troubles.

The list of negatives about social media goes on and on. Studies have found that social media sites make “more than half of users feel inadequate” according to one survey and that looking at other people’s selfies is correlated with lower self-esteem.

Another study found that the more time people spent on Facebook, the more their life satisfaction declined over time and the worse they would feel later on in the same day.

Think that’s all the bad news about social media? Not at all. Studies have found that social media can have a negative impact on relationships, can instigate feelings of frustration driven by envy, and make people feel more lonely.

“Don’t let the noise of others’ opinions drown out your own inner voice.”

– Steve Jobs

Don’t get me wrong– there are definitely some incredible things about social media. It’s a truly powerful tool that can be used to connect people across geographic barriers, teach you about things you never would have learned about otherwise, and provide valuable and meaningful entertainment. You can use your social media as a marketing tool for your business that allows you to reach way more people than you could without these platforms.

However, many of us aren’t very conscious about how we’re using social media. It’s easy to just grab your phone and start scrolling whenever you have a free minute or otherwise don’t know what to do with yourself.

It’s amazing how much time can be spent staring at our phones and taking in information that is not particularly useful or interesting to us.

When you look at the increasingly large number of studies that have been done about social media and mental health, it implies that we might want to step back individually and as a society and learn to be more conscious of our social media use.

After all, we only have so much time in our lives.

Do you want to look back on your life when you’re old and realize you spent a good chunk of it staring at other people’s selfies?

Let’s face it: social media can make us feel terrible about ourselves. It can leave us comparing ourselves to the carefully curated images of other people, that more often than not don’t even really reflect their lives.

It can also create pressure within us to produce an online personality that is accepted, affirmed, and validated by other people. It is all too possible to put almost all of your energy every day towards carefully orchestrating the persona we project online.

At the end of the day, this activity comes down to caring way too much about what others think. We look at social media and we judge others, we look at social media and we feel judged by others. This aspect of the relatively new social phenomenon isn’t healthy for anyone.

If you feel like you care way too much about what other people think, try staying off social media for a week. Heck, try staying off it for a day. There’s a good chance you’ll find a lot of benefits in logging off and focusing on yourself and doing something else with your time.

In our hyperconnected world, it's easy to never spend any time with your own thoughts. If you're always plugged into the opinions of others without spending any time with your own, you're much more likely to fixate on what other people think.

Remember, you have control over how you spend your time and what you spend your time thinking about. If you feel like you care too much about what people think, try to pull back on how much content and media you consume. If the media you're consuming is garbage and you know it, find your self-control and stop.

A terrifying number of people spend most of their free time mindlessly consuming content without balancing this out with productive self-growth activities or working to achieve goals.

If you're all wrapped up in what other people are saying, it might be time to log off and recenter.

If you think life is about impressing other people, you probably won't realize one of the most profound truths of life: mistakes are how you learn and challenges are opportunities for growth.

Do you want to grow? Do you want to become the best possible version of yourself before you die?

If you answered yes to these questions, it means you have (or aspire to have) a growth-oriented mindset rather than a fixed mindset. A growth-oriented mindset means you aren't afraid of mistakes or obstacles-- in fact, you welcome them as ways to learn, grow, change, and become your best self.

“One day, in retrospect, the years of struggle will strike you as the most beautiful.”

― Sigmund Freud

I've had a lot of setbacks in my life that were actually golden opportunities.

Years ago, I almost gave up and sold my blog when it wasn't taking off. It was easy to feel like a failure, to feel like other people would judge me for my unsuccessful venture.

“Adversity causes some men to break; others to break records.”

– William Arthur Ward

Luckily, I didn't let my fear of what other people thought dictate my actions.

Instead of throwing in the towel, I doubled down. In less than ninety days, the blog made a million dollars.

Here's another example: In 2011 I lost everything when Google changed its algorithm basically overnight.

I could have spent my time feeling ashamed that my project had failed. I could have gotten all caught up in what my friends and family might think, or even about the opinions of random strangers.

But I didn't.

Instead, I put my nose to the grindstone. I rebuilt from the ground up. Just four short years later, I was able to retire a multi-millionaire.

I'm not trying to brag. The point is to show that your choice to have a growth-oriented mindset or a fixed mindset can have a very well impact on your life.

The journey to being your best self is a fascinating one– you both have to practice self-acceptance while also constantly scrutinizing your own opinions and beliefs. You have to, at once, believe in yourself and doubt yourself.

A lot of this advice so far has been about the fact that you shouldn’t let other people’s opinions bring you down or dictate your life.

At the same time, though, none of us are perfect. We make mistakes, we hold opinions we haven’t thought through, and we act from beliefs we don’t understand in ways that contradict the values we want to hold.

One of the worst things that you can do in life is be unwilling to question your own opinions.

Sometimes, we can believe that our thoughts, beliefs, and opinions are so central to our identity that we assume we wouldn’t know who we were if we changed them. In reality, though, if we are unwilling to question the contents of our own minds, we can get stuck in our ways and close ourselves off from opportunities in life.

Sadly, some people get trapped believing that the personality they picked up somewhere around middle school is fixed, and they don’t let themselves grow because they are too afraid to doubt themselves.

Learning how to change your mind is a huge asset to living a fulfilling life.

It can also make you more forgiving of other people because you recognize that the perspectives they hold now might not be the same as those they hold in a few months, years, or decades. At the same time, it helps you learn to forgive yourself and recognize that every time you’ve thoughtfully changed your mind, you’ve grown a little.

It is all too easy to get stuck in your own head. You can spend hours, days, weeks, or an entire life laying around worrying about what other people think.

Concerning yourself with the opinions of others can be paralyzing, as it can make you question everything you do. The less you do and the more you stay in your head, though, the more intense this cycle can get.

If you feel like you care way too much about what others think, get out there and do something. Anything.

Exercise can be an awesome way to get the right brain chemicals flowing and burn off all of those self-conscious anxieties. Go for a run or a walk, hop on your bike, do some yoga, put on some music and dance, play tennis, shoot some hoops– it doesn’t matter. You might just find that moving around has a huge impact on your tendency to focus too much on what others think.

You can also take up some new hobbies or activities that you find enjoyable. Do something that you wouldn’t normally do for fear of what people would think. Whether it's starting a business, going to a concert alone, or writing a book, there is tremendous value in self-directed action.

Go have fun– you only live once! If other people want to give you a hard time for what you’re doing, that’s their problem, not yours.

There are people out there that absolutely despise Mother Theresa and the Dalai Lama. Long story short, no matter who you are, you absolutely cannot make everyone happy, no matter how hard you try. As it was once said, “the key to failure is trying to please everyone.”

This can be a hard pill to swallow if you’ve always been a people pleaser. If you run around your whole life, though, simply trying to make everyone happy and ensuring that no one is ever mad at you, you’re going to drive yourself mad. At the same time, you won’t get to do the things in life that really matter to you.

“You can’t be an important and life-changing presence for some people without also being a joke and an embarrassment to others.”

– Mark Manson

If you feel the urge to change who you are to make someone else happy or say something you don’t believe to please another person, stop and take a step back. Ask yourself why you would let this singular other person take control over how you are feeling. Consider the fact that you are totally free to separate how the person thinks about you from your own sense of self-worth.

No matter who you are, no matter how much good you do in the world, there are people that will criticize you. In fact, the more of a stand you take in life, the more opposition you will face. This is, for better or for worse, just a part of the deal of being a person.

The reality is, though, that we are all individually responsible for our own happiness. You can’t make someone else happy.

From this perspective, all we can do is try to be the best people we can be and hope that others do the same. If you encounter some perpetually disappointed people along the way, (which you surely will,) it’s essential to find a way to accept that you simply can’t please everyone.

“Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.”

– Bertrand Russell

As a final point, don't let the fear of being "weird" keep you from being your true self. Being normal is boring anyway.

We are human, and it’s easy to get caught up in the human world. If you are actively feeling overwhelmed by what other people think of you, get out of your house and get out in nature.

“If words control you, that means everyone else can control you. Breathe and allow things to pass.”

– Warren Buffett

Whether you head to your local nature path or you take a drive to a nearby mountain, there’s nothing better than spending some time with mother nature to help you gain some perspective.

You might just find that the things you've been fixating on don't really matter that much in the big picture, and help you remember or get in touch with your larger purposes.

We don’t like to think about death in our culture, but that doesn’t change the fact that every single one of us will die someday.

If you find that you’re so concerned with what others think that it’s holding you back from living your life, you might want to try out a practice known as memento mori. Latin for “remember that you [have to] die,” the ancient Stoic philosophers were particularly notable for their use of this discipline.

When you contemplate the fact that you will die, it can change your entire perspective on life. All of a sudden, the fact that people might make fun of you if you start that YouTube channel or quit your job to pursue your dream business stops being so important.

One particularly useful practice is to imagine yourself on your deathbed at the end of your life. As you're laying there and reflecting on the life you lived, what do you want to know you have done? What would you regret not having done?

This can be a great way to re-orient yourself when you’ve let yourself get pulled away by other people’s ideas, opinions, thoughts, and desires. The more you practice this discipline, the more you won’t let the passing judgments of others affect your ability to live your best life.

Are you totally consumed with what other people think, even anonymous posters online? To cut through the noise, start a journal.

This is a great way to get to know your own thoughts and make sense of your feelings, experiences, beliefs, and life.

Are you finding yourself fixating on what other people think? No problem. Start writing in your journal and reconnect with yourself. You'll likely find whatever is being said doesn't matter much at all in the grand scheme of who you are and what you want to accomplish.

I've written about how consumerism is the ultimate emotional scam in the past. If your primary concern is the thoughts of other people, you're on a fast track to getting caught up in social status in material wealth instead of the things that really matter in life.

Moving beyond a fixation on keeping up with the Joneses is essential if you want to really stop caring what other people think.

In fact, even if you have the wealth to show off your status with luxury experiences and flashy stuff, there are a lot of reasons why keeping your wealth a secret is the better road.

If you search on Reddit for “how to not care what other people think about you,” a surprising answer pops up over and over again.

“Get older,” they say.

There is some truth to this. Life consists of many seasons, and we tend to care more about what people think about us when we are younger. That being said, there are plenty of people that are closer to death than birth who are completely consumed with pleasing other people and receiving validation from everyone but themselves.

“We cling to our own point of view, as though everything depended on it. Yet our opinions have no permanence; like autumn and winter, they gradually pass away.”

– Zhuangzi

Getting some perspective on the fact that there are different phases to our lives can help if you feel you simply can’t let go of other people’s opinions.

Work on getting in touch with yourself, practice being self-aware of your own thoughts and feelings, and try to identify what your goals and purposes are. If you can do these things and let time pass, you’ll wake up one day and realize that you don’t spend nearly as much time focusing on other people’s opinions.

Don't let people convince you that what you do in your own life doesn't matter. Don't let the people you're around convince you that you should "stay in your lane" or that your goals are pipedreams.

Take yourself seriously. When you do this, other people take you seriously, too.

“Lend yourself to others, but give yourself to yourself.”

– Michel de Montaigne

If you don't take your life seriously, you probably won't live a life that you're proud of. You might get in the habit of sabotaging yourself and even resenting people that do take themselves seriously.

That's no way to live.

"Make the most of yourself, for that is all there is of you."

– Ralph Waldo Emerson

Remember, you are the only person in the entire universe that can make your life what you want it to be. So take it seriously and don't pay any mind to people that give you slack for doing so.

Social media makes it easy to constantly compare yourself to the carefully curated personas of other people.

“Do not overrate what you have received, nor envy others. He who envies others does not obtain peace of mind.”

– Buddha

When we compare ourselves to others too much it can destroy our self-esteem and make us focus too much on what others think. Instead of envying others for what they have accomplished, turn envy into appreciation and use it as motivation and inspiration to be who you want to be.

“Appreciation is a wonderful thing: It makes what is excellent in others belong to us as well.”

– Voltaire

Rather than comparing yourself to other people, compare the person you are today with the person you were yesterday. Personal growth is a slow, steady hike-- it's a marathon, not a sprint. As long as you're making progress one day at a time, you're on the right path.

Instead of being defensive when you receive negative feedback, be curious. This won't just help you build more meaningful relationships with the people you're close to, but it can also mean that you could gain some valuable information that could benefit your growth as a person.

There's a lot of talk these days about the benefits of practicing gratitude, and for a good reason-- it works.

When you arise in the morning think of what a privilege it is to be alive, to think, to enjoy, to love.

– Marcus Aurelius

Focusing on what you're grateful for rather than what you don't have can help you stay centered in yourself rather than focusing on the opinions of others.

We all make mistakes. Sometimes, we make big, life-changing mistakes. Maybe your little mishap has become the talk of the town.

It can be hard to forgive yourself when this happens, and it isn't necessarily an overnight process. No matter how big or small the mistake that is weighing on your mind, this is the perfect time to turn inward and find the piece of gold hidden in the experience.

"Every difficulty in life presents us with an opportunity to turn inward and to invoke our own inner resources. The trails we endure can and should introduce us to our strengths."

– Epictetus

Instead of putting all of the value on what other people are saying, reconnect with yourself, learn what you can, and learn to forgive.

Letting go of what other people think about you isn't easy, and it can take time to break the habit of fixating on the opinions of others. With attention, effort, and time, though, you can refocus on yourself and stop caring about what other people think about you. The sooner you can shed your fixation on other peoples' opinions, the sooner you can start pursuing your deepest goals and purposes.

So, who am I to be telling you how to stop caring about what people think? You can learn more about me and my projects here.

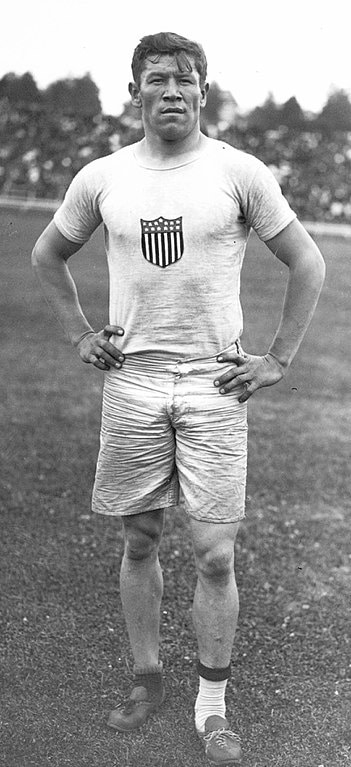

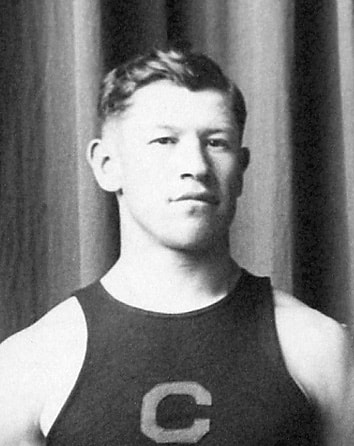

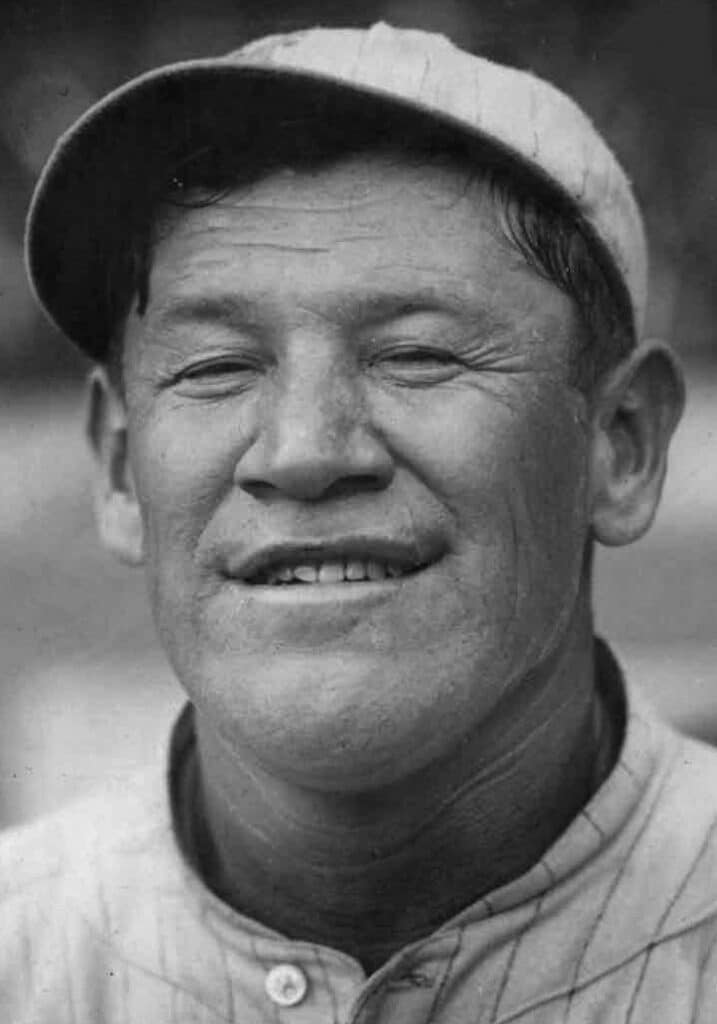

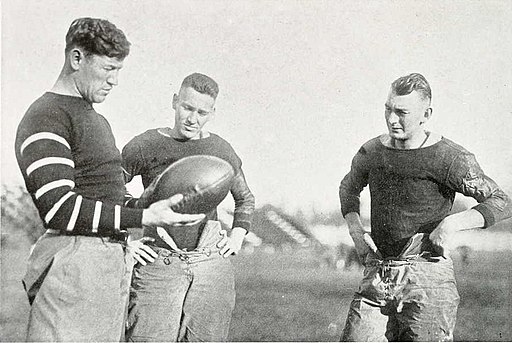

Have you heard the story of Jim Thorpe?

Not only was he the first Native American to win gold at the Olympics, but he's easily one of the most athletic human beings in history. He didn't just dominate at the 1912 Olympics with minimal training, but he obliterated nearly every sport he tried. During his unbelievable career, he played professional football... and professional baseball... and professional basketball.

Jim Thorpe's story is the story of a man overcoming utterly impossible obstacles in such a way that it seemed almost easy. He had to overcome personal tragedy, unbelievable racism, sabotaging teammates, and the death of multiple family members - including his mother - when he was a child. But he still overcame.

In his legendary 1912 Olympic events, someone stole his shoes - so he simply found two mismatched shoes in the garbage. One was too big and one was too small. Oh, and he still won gold. And then set several records, which you'll learn about later in this essay. The man was essentially unstoppable.

Jim Thorpe is a personal hero of mine and, I believe, the greatest athlete to have ever lived.

Jim Thorpe was a legendary Native American athlete who dominated the 1912 Olympics, winning gold. He also played professional football, professional baseball, and professional basketball.

When you think of the greatest athletes of all time a few names likely come to mind. Michael Jordan, Muhammad Ali, Wayne Gretzky, and Babe Ruth are some of the world's most famous and skilled athletes and consistently land in the top five when listing out the greatest athletes ever.

Another name that frequents these lists is Jim Thorpe. While his name might not be recognizable to the average American anymore, he was once a household name across the country. I think it's time Thorpe made a comeback. If you want to remember people for their athletic accomplishments, then everyone should know his name and story.

Unlike the other legends listed above, Thorpe didn't just excel in one particular sport. When you're talking about who the greatest multi-sport, all-around athlete is, most people would tell you that the answer is undoubtedly Jim Thorpe.

Sure, there are some other incredibly talented multi-sport athletes out there and men with remarkably versatile skills. Deoin Sanders, Carl Lewis, Wilt Chamberlain, and Jim Brown come to mind.

But Thorpe was in a league of his own.

He won the gold in the 1912 Olympic Games in both the pentathlon and the decathlon-- both of which are multi-event games that show his ridiculous versatility.

He didn't stop there, though. He played major league baseball for seven years, professional football for 13 years, and professional basketball for at least two years.

It's really difficult to say which sport Thorpe is best known for.

He was an All-Pro back as a professional football player. He kept the Olympic record for his points total for two decades after winning eight of the fifteen individual events of the decathlon and pentathlon.

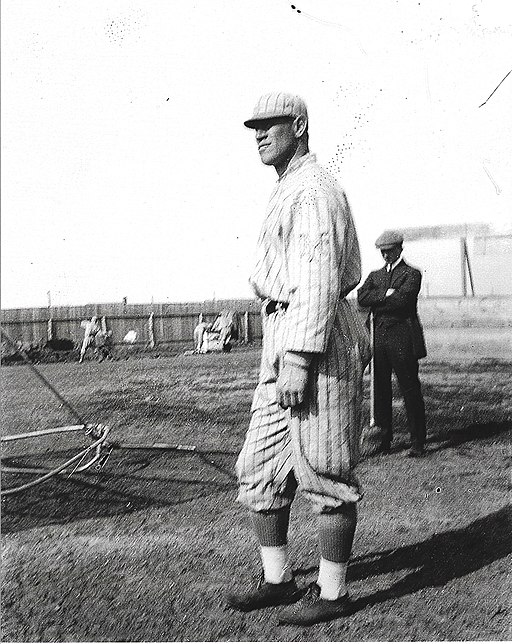

As a basketball player, Thorpe displayed his abilities barnstorming all over the country. While his baseball numbers weren't statistically outrageous, the fact that he was able to compete at the highest level of the game certainly says something.

Basically, Thorpe could play any sport he tried with ease. He is a true sports legend and an American icon.

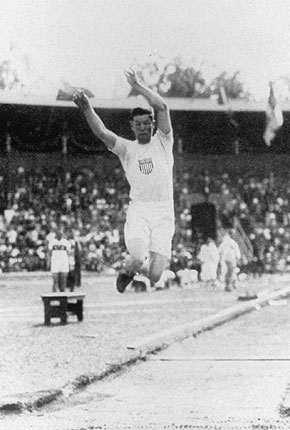

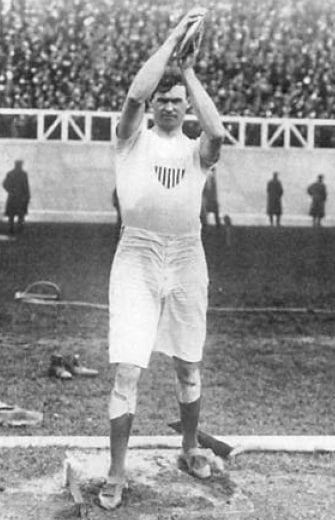

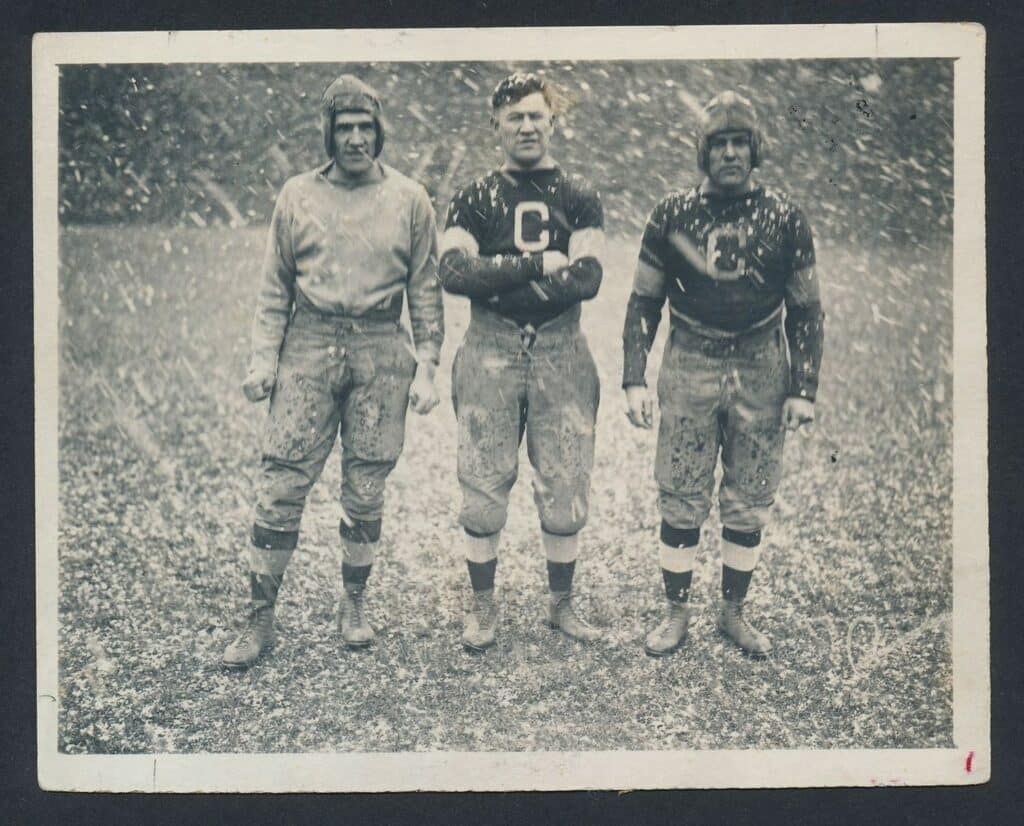

If you've ever come across a social media post about Jim Thorpe, there's a good chance it was accompanied by this picture of the legend during the 1912 Olympic Games:

Why, you ask?

Look at his feet-- he's wearing two different shoes.

When this photo was taken, Thorpe had already crushed the field in the pentathlon, placing first in four of the five events. During the 1,500-meter run, he left his opponents in the dust, beating the man in second place by nearly five seconds.

The next week, it was time for him to compete in the decathlon which occurred over the course of three days.

In the pouring rain, Thorpe ran an 11.2-second 100-meter dash. No one was able to match that time at the Olympics until 1948.

Sometime after this event, just about the worst thing that can happen to a track and field athlete during the Olympics happened-- his shoes went missing.

Some accounts say that his shoes were missing on the second day of the decathlon. Others say that they disappeared a few minutes before the 1500-meter race portion of the decathlon was about to begin.

There are a lot of different theories about what exactly happened here-- who took Thorpe's shoes? Why were they missing? Had they been stolen?

Bob Wheeler, the author of the biography Jim Thorpe: The World's Greatest Athlete and the founder of the Jim Thorpe Foundation, believes that it was right before the 1500-meter race that his shoes went missing. He is a fairly credible source, considering that he conducted more than 200 interviews with teammates, friends, and family members of Jim Thorpe while writing his 1979 biography.

According to Wheeler, the story goes like this:

A few minutes between the decathlon's 1500-meter race, Thorpe's shoes were nowhere to be found. One of his teammates gave him one shoe to borrow. The second shoe? He found it in the garbage.

Not only was he wearing two mismatched shoes, but one of them was way too big for his foot and one of them was way too small.

The solution?

Thorpe squeezed his foot into the small shoe and wore extra socks on one of his feet to make the shoe fit better.

Most of us would whine and complain if we had to walk around in a too-big shoe and a too-small shoe for ten minutes at the grocery store.

Thorpe didn't just go out and compete against the world's greatest decathletes in the 1500 meters with mismatched shoes that didn't fit. He went out and won.

This is a timeless story that has a powerful message more than one hundred years later. It says never give up. Never quit. Never let obstacles stop you from attaining greatness.

Thorpe was the winner of the final event of the Olympic Games-- the 1500 meter (it's worth noting that Thorpe ran the 1500 meter twice during the Games, once for the pentathlon and once for the decathlon. He smoked the competition both times.)

Each gold medalist was crowned with a laurel wreath as they came up to receive their medals by King Gustav of Sweden.

According to the New York Times, the crowd gave a "great burst of cheers led by the King" when Thorpe received his pentathlon gold.

For his decathlon performance, Thorpe wasn't just given his medal. He also received a bust of the king and a Viking ship-shaped jewel-encrusted chalice.

King Gustav of Sweden grabbed Thorpe's hand firmly and said, his voice shaking with emotion:

"Sir, you are the greatest athlete in the world."

What did Thorpe say in response?

"Thanks, King."

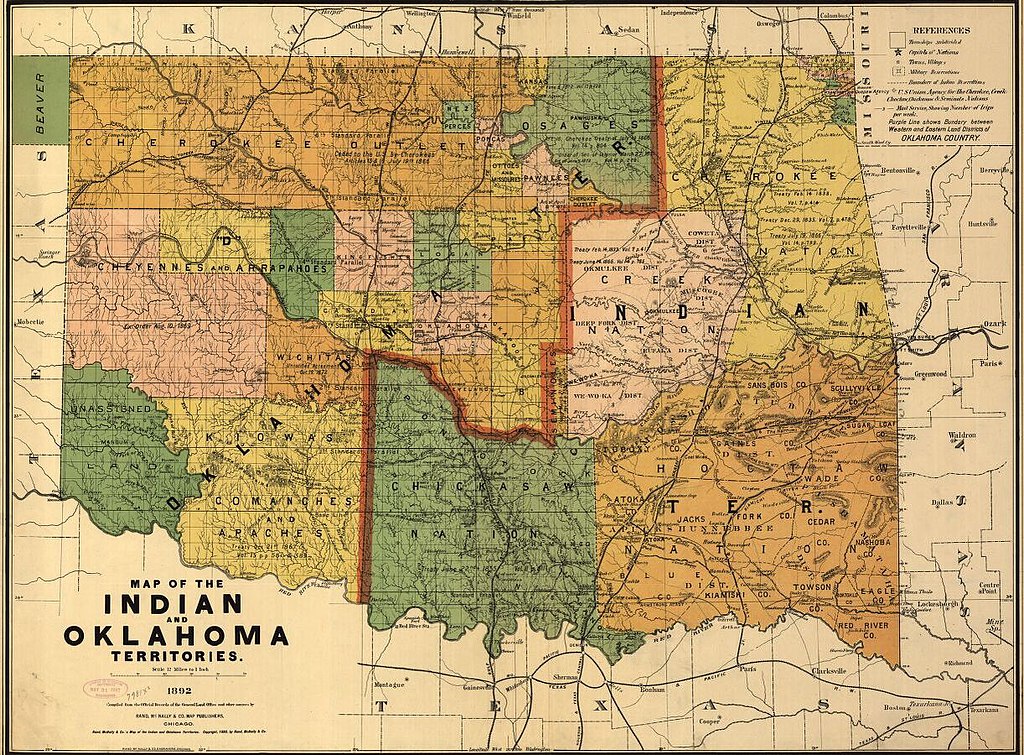

There is a lot we don’t know for certain about the beginning of Jim Thorpe’s life.

While it’s known that he was born in Indian Territory that would later be known as the state of Oklahoma, and he was baptized as “Jacobus Franciscus Thorpe” in the Catholic Church, no birth certificate was ever found for the American hero.

Most biographers believe that Thorpe was born near the town of Prague on May 22, 1887, which is the date that is listed on his baptismal certificate. However, Thorpe himself once said his birthday was May 28, 1888, in a note to The Shawnee News-Star in 1943. He also said that he was born:

“...Near and south of Bellemont– Pottawatomie County– along the banks of the North Fork River… hope this will clear up inquiries to my birthplace.”

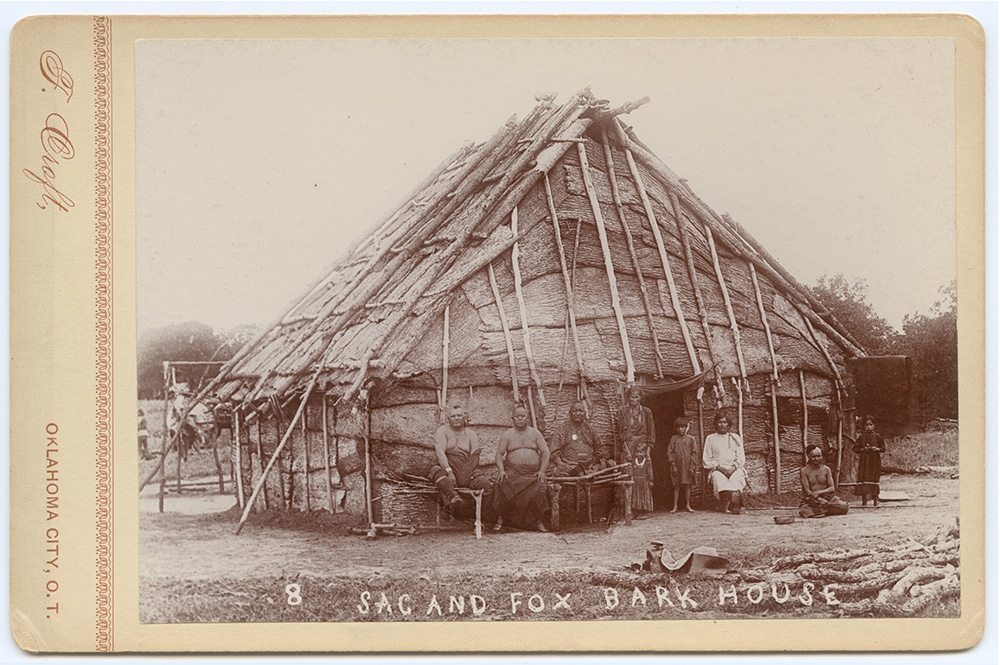

Jim Thorpe grew up fishing, hunting, and learning from elders in what is now central Oklahoma, but what was, at the time, Sac and Fox land. He also played sports growing up, with baseball being an early favorite.

Both the parents of Jim Thorpe were of mixed-race ancestry. Hiram Thorpe, his father, was born to a Sac and Fox Indian mother and an Irish father. Charlotte Vieux, his mother, was born to a Potawatomi mother (descended from Chief Louis Vieux) and a French father.

According to popular legend, Jim Thorpe is a descendant of the infamous warrior Chief Black Hawk.

The autobiography of Black Hawk, entitled Autobiography of Ma-Ka-Tai-Me-She-Kia-Kiak, or Black Hawk, Embracing the Traditions of his Nation, was the first Native American autobiography that was published in the United States.

“I am no more proud of my career as an athlete than I am of the fact that I am a direct descendant of that noble warrior [Chief Black Hawk].” – Jim Thorpe

The native name of Jim Thorpe was Wa-Tho-Huk, which can be translated to mean “path lit by great flash of lightning,” or, more succinctly, “Bright Path.”

Raised as a Sac and Fox Indian, Thorpe’s native name comes from the fact that the path that led to the cabin where he was born was brightened by lightening around the time of his birth. This was custom for the Sac and Fox, who named their people something that happened near birth time.

Thorpe had a twin brother named Charlie, and the two of them attended the Sac and Fox Indian Agency school in Stroud. Sadly, Charlie died of pneumonia when the boys were nine.

It is known that Thorpe ran away from the school he attended a number of times. Eventually, he was sent to an Indian boarding school (the Haskell Institute in Lawrence, Kansas) by his father. The reason he was sent away? So he would stop running away.

His life was struck by tragedy again when his mother died of complications during childbirth just two years after Thorpe was sent to the Haskell Institute. Understandably, he was left deeply depressed by the death of his mother. After getting into fight after fight with his father, Thorpe decided to leave home in order to work on a horse ranch.

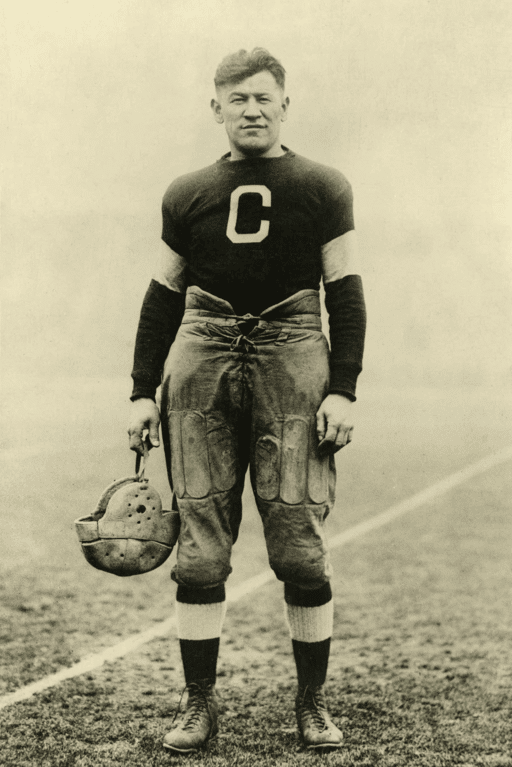

When Thorpe was about sixteen in 1904, he went back to see his father again. He decided to go to the flagship Indian boarding school in the U.S. during the time– Carlisle Indian Industrial School in Carlisle, Pennsylvania. This school was founded in 1879 with the purpose of training Indians for hands-on trades and assimilating them into mainstream culture.

It was during this time that Thorpe’s incredible athletic ability was first recognized.

He was coached by one of the most influential coaches of early American football– Glenn Scobey “Pop” Warner.

Soon thereafter, Thorpe’s father died from gangrene poisoning after a hunting accident. This left the young man an orphan, and he dropped out of school once again. Before later returning to the Carlisle School, Thorpe spent another few years working on farms.

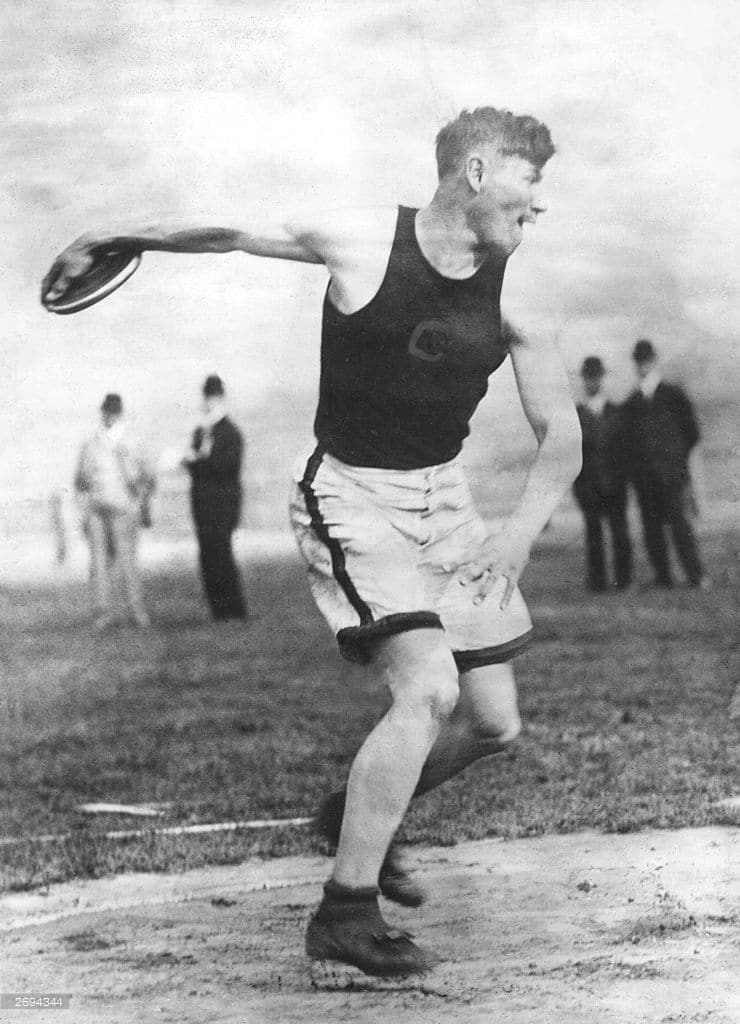

In 1907, In his third year at the school, Thorpe wandered by track and field practice and easily cleared a 5’9” high jump bar wearing his heavy overalls. In his plain street clothes, he beat all of the school’s high jumpers.

He didn’t just impress people with his athletic abilities in track and field, though. During this time, he also competed in:

That's right– ballroom dancing. In fact, he won the 1912 intercollegiate ballroom dancing championship.

Though Pop Warner was reluctant to let his best track and field athlete play the intensely physical sport of football, Thorpe convinced him to let him attend practice and try some rushing plays against the school’s defensive team.

Warner permitted this, figuring that Thorpe would quickly give up the idea after being tackled easily.

Of course, that never happened. Instead, Thorpe “ran around past and through them not once, but twice.” After his impressive display, Thorpe flipped Warner the football while saying that “Nobody is going to tackle Jim.”

It was in 1911 that the American people started to notice Thorpe’s tremendous athletic ability. In a game against Harvard, a top-ranked team at the time, Thorpe scored all four of the field goals in the 18-15 upset. Amazingly, his team completed this season with a record of 11-1.

Thanks to Thorpe, Carlisle won the national collegiate championship in 1912. During the season, he scored a whopping 198 points and scored 25 touchdowns. By some accounts, he was responsible for 224 points and 27 touchdowns during this time.

Jim Thorpe even played against future President Dwight D. Eisenhower during a 1912 game against the West Point Army team. While the 92-yard touchdown Thorpe made during the game was nullified due to a penalty against a teammate, Thorpe rushed for a 97-yard touchdown in the next play. During the game, Eisenhower injured his knee when attempting to tackle Thorpe.

Eisenhower spoke of Thorpe’s performance during this game in a 1961 speech, stating that:

“Here and there, there are some people who are supremely endowed. My memory goes back to Jim Thorpe. He never practiced in his life, and he could do anything better than any other football player I ever saw.” – Dwight D. Eisenhower

In 1908, Thorpe received third-team All-American football honors. After heading to North Carolina for a time to pitch for the Rocky Mount Railroaders, Thorpe was lured back to Carlisle by Pop Warner. In 1911 and 1912, he was named a first-team All-American.

Even though Thorpe would gain his greatest fame from track and field, he didn’t compete in the sport in 1910 or 1911. Despite his incredible skills in a number of athletic endeavors, football was Thorpe’s favorite sport to play.

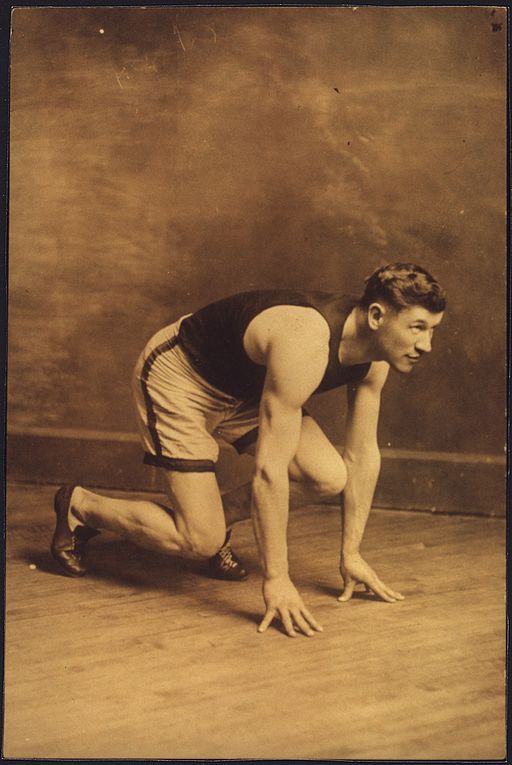

Jim Thorpe started training for the Olympics in the spring of 1912. Initially, he focused on hurdles, shot-puts, and jumps. However, being so incredibly versatile and skilled as an athlete, he added in the javelin, pole vaulting, discus, 56 lb weight, and hammer.

He earned himself a spot on the Olympic team thanks to his all-around ability during the Olympic trials held at Celtic Park in New York.

There were two new multi-event sports included in the 1912 Summer Olympics– the pentathlon and the decathlon.

The pentathlon was based on the event that had been a part of the Ancient Olympic Games, and consisted of:

The decathlon was also inspired by the pentathlon, but instead of consisting of five events, this one had ten. All the way back in 1884, there had been a ten-event competition known as the “all-around” or “all-round” championship which was quite similar to the modern decathlon.

The first appearance of the modern decathlon as a part of the Olympic Athletics program was at the Stockholm 1912 games– the games where Jim Thorpe displayed his superior athletic abilities.

The decathlon is split into two different days of events:

Since Thorpe was so versatile as an athlete (for example, he had gone to a number of track meets with Carlisle and served as a one-man team,), both of these new Olympic sports seemed the perfect fit for Thorpe.

After entering the trials for both events, Thorpe earned a place on the pentathlon team and was chosen to represent the U.S. in the decathlon.

You would think that competing in these two multi-sport events would be enough for most athletes. Thorpe, though, also competed in the high jump and the long jump at the 1912 games.

The first competition Thorpe competed in during the games was the pentathlon on July 7. Out of the five events, he won four. The fifth event– javelin– he had never competed in before that year and still placed third.

Thorpe won the gold medal and went on to qualify for the high jump final the same day. A few days later, he participated in the long jump and placed seventh.

The last event Thorpe participated in during those summer games was the decathlon. This was his first and only decathlon in his entire life.

He went into the competition with some serious competition lined up. Everyone was expecting a strong performance by Hugo Wieslander, a Swedish athlete that had set the inaugural world record for the pentathlon the previous year.

He was no match for Thorpe in these games, though. Jim Thorpe defeated Wieslander in the decathlon by 688 points. Out of the ten events, Thorpe placed in the top four in every single one.

For nearly two decades, his Olympic record of 8,413 points stood strong.

Out of the fifteen individual events that made up the decathlon and the pentathlon, Thorpe won eight.

All of this is remarkable on its own. To understand just how incredible his feats were during those games, you have to realize that someone had stolen his shoes just before he was due to compete.

While many athletes might be completely shot down by this occurrence, which their shoes being the most essential gear they have, Thorpe quickly found two replacement shoes. Not only were the shoes mismatched, but he fished one of them out of a trash can.

A true king, he put these ill-matched shoes on and won the gold medal.

The 1912 Summer Olympics also saw the sport of baseball for the first time in the history of the games. Included as a demonstration sport (meaning it was played to promote it rather than as a regular medal competition,) a game was played between the United States and Sweden.

The U.S. team was made up of various members of the track and field athletics delegation. One of the participating athletes was Jim Thorpe himself, who played in one of the two exhibition baseball games.

At the closing ceremonies of the games, Thorpe won two gold medals as well as two challenge prizes. These were donated by Czar Nicholas II of Russia for the pentathlon and King Gustav V of Sweden for the decathlon.

It is said that King Gustav commented to Thorpe when he was giving him his prize:

"You, sir, are the greatest athlete in the world"

Thorpe is believed to have simply said in return:

“Thanks, King.”

When Thorpe came home, he was given a hero’s welcome. At a ticker-tape parade on Broadway shortly thereafter, he was the star attraction.

After his domination at the Olympics, Thorpe went back to Celtic Park where he had qualified for the games several months earlier. There, he competed in the Amateur Athletic Union’s All-Around Championship.

Out of the ten events held, Thorpe won seven.

What happened in the other three? He came in second, of course.

During his performance, Thorpe broke the previously standing record of 7,385 points that had been set several years earlier in 1909 by achieving a total point score of 7,476.

The broken record had been held by Martin Sheridan, who was the Irish American Athletic Club’s champion athlete. Sheridan himself was no lightweight when it came to athletics, having won five Olympic gold medals.

When Thorpe broke his record, he was there to watch it happen.

A good sport, he went up to Jim Thorpe after the event. As he reached out to shake his hand, he said:

"Jim, my boy, you're a great man. I never expect to look upon a finer athlete."

Sheridan went on to sing Thorpe’s praises to a New York World reporter, saying:

"Thorpe is the greatest athlete that ever lived. He has me beaten fifty ways. Even when I was in my prime, I could not do what he did today."

In 1912, athletes participating in the Olympics were held to strict rules about amateurism. At the time, athletes weren’t considered amateurs if they:

In order to compete in the Olympics, athletes had to be amateurs and not professionals by this definition.

Months after Thorpe’s domination of the games, in January 1913, it was reported that he had previously played professional baseball by the Worcester Telegram. The story was further circulated by newspapers around the country.

In 1909 and 1910, Thorpe received meager pay as a professional baseball player in the Eastern Carolina League. It is reported that he received somewhere between $2 and $35 per week, which, in today’s money, amounts to a range of $58 and $1,018.

The kicker was that college athletes regularly played professionally during the summers to help them earn some money. To sidestep rules against amateurism, most of these players used aliases. Thorpe, however, did not.

The American public didn’t care that Thorpe had briefly played professional baseball. He was an American hero. However, the case was taken very seriously by the Amateur Athletic Union. One of the founders and the secretary of the AAU, James E. Sullivan, was particularly concerned with Thorpe’s previous stint playing professional baseball.

Thorpe wrote a letter to Sullivan to help explain that, while he had played pro baseball, he didn’t know he was doing anything wrong. In fact, he was just following the example of other college athletes.

“I hope I will be partly excused by the fact that I was simply an Indian schoolboy and did not know all about such things. In fact, I did not know that I was doing wrong, because I was doing what I knew several other college men had done, except that they did not use their own names …”

This honest admission, unfortunately, didn’t help his case. Thorpe’s amateur status was retroactively withdrawn, and the International Olympic Committee stripped him of the titles, medals, and awards he had won in the Olympics.

To further complicate the controversy, both the AAU and IOC had broken their own rules in disqualifying Thorpe. Protests had to be made “within 30 days from the closing ceremonies of the games” according to the 1912 Olympics rule book, but the first reports of the issues didn’t pop up until six months after the conclusion of the games.

Beyond that, there’s even some evidence that Thorpe’s time playing pro baseball was known to the AAU before he competed in the Olympics. Only when confronted with this fact did they decide it was a meaningful issue.

It wasn’t until three decades after his death that his status as an amateur was restored in 1982 and his family was presented with two medals in a ceremony.

However, the battle to correct the record wasn’t over.

Even though the IOC had restored his status as an amateur and returned the medals to his family, they didn’t declassify the other medalists from the 1912 games. This means that he was still essentially considered a co-winner, rather than rightfully restored as the sole winner.

Believe it or not, it wasn’t until July 2022, 110 years after the Olympic Games in Sweden, that the IOC announced that Thorpe would be reinstated as the sole Olympic champion in both the pentathlon and the decathlon.

Being stripped of his medals was devastating to Jim Thorpe. The only positive outcome of the whole ridiculous endeavor was that he started receiving offers from professional sports clubs as soon as it was reported that he had been declared a professional.

Thorpe was a free agent at the major league level after the Olympics because his contract had disbanded in 1910 with the minor league team that he had last played for. This was highly unusual for the time because this was during the era of the reserve clause in North American professional sports. This meant that pro athletes rarely had the opportunity to change teams unless they were given an unconditional release.

This meant that Jim Thorpe had his pick of the litter when it came to which team to play for.

Turning down an offer with the St. Louis Browns, he decided to join the New York Giants. The Giants had been the National League champions the previous year.

With the help of Thorpe’s superior athletic abilities, the Giants once again became the National League champions in 1913.

Shortly after the Giants lost the World Series, they embarked on a world tour with the Chicago White Sox. Unquestionably, the celebrity on the tour was Jim Thorpe.

On this incredible journey around the country and the world, Thorpe was able to meet major world figures including Pope Pius X and Abbas II Hilmi Bey. He even played to a huge crowd in London that included King George V.

Thorpe continued to play sporadically for the Giants. He had a short stint with the Milwaukee Brewers (a minor league team) before returning to the Giants and then being sold to the Cincinnati Reds.

His team-hopping didn’t end there– he went back to the Giants before being traded to the Boston Braves in 1919.

Until 1922, Thorpe continued to play minor league baseball.

While it sounds like Thorpe was pretty busy playing baseball after the Olympics, he hadn’t abandoned his love of football. He played with the Pine Village Pros in 1913 and then with the Canton Bulldogs in 1915.

The Bulldogs certainly recognized the worth of this incredible athlete. Reportedly, Thorpe was paid $250 per game, which amounts to nearly $6,700 in today’s dollars. At the time, this was a truly incredible wage.

The team got their money's worth, too. Before Thorpe joined the team, about 1,200 would attend their games. For Thorpe’s debut game, 8,000 fans showed up– more than six times more than the average attendance.

Thorpe played for the Bulldogs for a number of years. In one particularly legendary championship game in 1919, Thorpe put the game out of reach to the competition by kicking a (wind assisted) 95-yard punt from the 5-yard line of his own team.

The Bulldogs were one of fourteen teams to form the American Professional Football Association in 1920– the organization that would become the NFL in just two years.

Who did they select as the inaugural president of the APFA? Why, Jim Thorpe, of course.

True to his nature, though, Thorpe just spent most of the year playing football for Canton. His tenure as the president of APFA only lasted until 1921.

Between 1921 and 1923, Thorpe helped to organize and played for an all-Native American team, the Oorang Indians.

Even though the team didn’t do that well, Thorpe’s incredible skills during the seasons were recognized. He was selected for the first All-NFL team in 1923, which later was recognized formally to be the league’s official All-NFL team.

After having played football for six different teams between 1920 and 1928 and playing in 52 games, Jim Thorpe retired from professional football at the age of 41.

Believe it or not, Jim Thorpe also had a basketball career that was unknown even to his biographers until 2005. How did they find out about his stint as a pro basketball player? From a ticket was found in an old book.

Thorpe played on a traveling basketball team as the primary feature of the “World Famous Indians” of LaRue. For at least two years, he barnstormed with the team in a number of states.

At this point, you must be thinking that we’ve reached the end of Thorpe’s athletic versatility. After all, he dominated in track and field while also playing professional baseball and football all while he was still a young man.

Believe it or not, though, Thorpe also considered going into professional hockey for the Tecumseh Hockey Club in Canada for a brief time in 1913. Imagine being so athletically talented that you could choose to play just about any sport at the pro level!

Over the course of his life, Thorpe married three times and was the father of eight children.